🔧 We’re Under Maintenance

We’ll be back shortly. Thank you for your patience.

We’ll be back shortly. Thank you for your patience.

India has set up a new financial institution to ensure the availability of long-term finance for its corporate sector, which currently depend on commercial banks for money. This could be a stepping stone to faster economic growth as India marches towards its goal of becoming a $5-trillion economy.

The Modi government will introduce the National Bank for Financing Infrastructure and Development (NaBFID) Bill, 2021 in Parliament to set up a new development financial institution to finance long gestation infrastructure projects in India.

This long awaited proposal was cleared by the Union Cabinet last week. NaBFID will have an initial capital of $2.9 billion, of which the government will give a quarter as an immediate grant. It will leverage its capital to raise $40 billion over the next few years from deep pocketed investors such as sovereign wealth funds (SWFs), other institutions and bond investors. The government is targeting a total loan book of $70 billion over the next three years.

In addition to providing long-term finance to infrastructure projects, NaBFID is also expected to help develop India’s currently nascent bond market. A functioning and dynamic bond market is considered a prerequisite for companies to be able to raise competitively priced long-term finance for projects with long maturity periods. There are also plans to amend existing rules to facilitate debt financing through infrastructure investment trusts (InvIT) and real estate investment trusts (REITs).

Read more on India’s infrastructure push:

India to spend big on infrastructure to push growth

Development financial institutions (DFIs) are lending organisations that raise money from the government and from long-term investors and lend to long gestation projects.

At present, Indian industry has little option but to tap commercial banks for their credit requirements. But banks, typically, raise money from depositors who park funds for fixed periods of seven days to five years. Banks are expected to return the money to depositors at the end of this period. But bank that lend money to infrastructure projects get back their capital only after a longer time lag – of seven to 12 years.

This creates an asset-liability mismatch in the banking system and forces banks to raise fresh deposits to pay back old ones even as their long-term loans take time to mature.

Then, most banks don’t have the capability to judge the financial viability of really long-term infrastructure projects. This often leads to credit being advanced to undeserving projects and results in the creation of delinquent loans in the books of the lending institution(s).

NaBFID will have an initial capital of $2.9 billion. It will raise $40 billion over the next few years… The government is targeting a total loan book of $70 billion in three years.

In emerging nations such as India, even the financial markets are not sophisticated enough to meet all the needs of development finance that arise for the corporate sector, the government and other institutions. DFIs fill this gap with government support, particularly to fund riskier projects that require long-term money.

DFIs, which have access to long-term finance, and have specialised knowledge in assessing infrastructure projects are, therefore, better equipped to deal with these issues.

India needs DFIs for the following reasons:

i) To direct debt flows to infrastructure projects

ii) To provide credit enhancement for infrastructure projects

iii) To improve long term finances of the corporate sector

iv) To boost economic growth

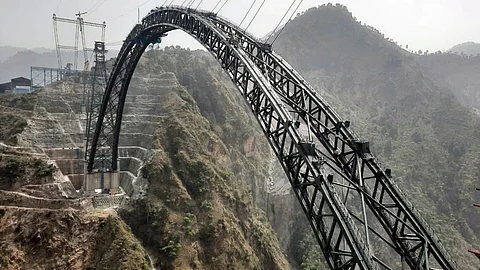

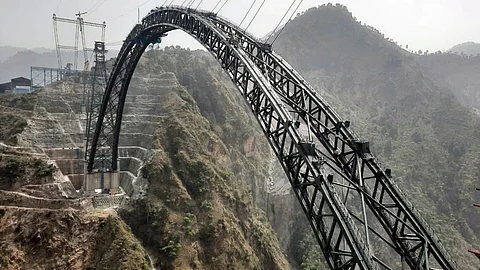

The government has announced a massive $1.4-trillion programme to build roads, energy infrastructure, railways, agricultural infrastructure, education, healthcare and digital services across 18 states and Union Territories over five years.

Called the National Infrastructure Pipeline (NIP), the plan envisages the Centre to meet 39 per cent of the proposed expenditure, the states to put up a matching amount and the private sector the rest.

It is widely accepted that the poor state of India’s infrastructure is one of the major contributing factors inhibiting the government’s efforts to position India as the world’s next manufacturing hub. According to some estimates, this raises the cost of doing business in India and makes Made in India goods uncompetitive in global markets.

In India, the financial markets are not sophisticated enough to meet the needs of the corporate sector. DFIs fill this gap, particularly to fund riskier projects that require long-term money.

Therefore, all out efforts are required to bridge this infrastructure deficit. As part of NIP, the government has clearly set out the sectors that will receive the most funds and attention – Energy (24 per cent), Roads (19 per cent), Urban Development (16 per cent) and Railways (13 per cent). These four sectors alone will account for about 72 per cent of the projected capex.

All of them are sectors where projects continue to long periods – sometimes up to 12-15 years. Thus, a dedicated DFI for meeting their funding requirements could be just the boost the economy needs to move into a faster growth path.

In India, the bond market has not developed to the extent considered necessary for an economy with a GDP of close to $3 trillion. It is still heavily skewed in favour of government securities and lacks depth.

NaBFID has been given the responsibility of ensuring that the Indian bond market develops sufficiently so as to be able to sustain the requirements of India’s gargantuan infrastructure building ambitions. Although the fine print is still not available, experts feel the government want it to play the role of both bond seller and market maker, at least in the first few years.

“This may appear to be a conflict of goals. But it is important to note that there need to be certain preconditions for a market to emerge. The role played by NABFID in the development of India’s infrastructure financing market would allow those preconditions to be met by ensuring that there is adequate interest among investors right from the start,” an article in the Mint, a leading Indian daily, by Vivek Singh, Officer on Special Duty to India’s Finance Minister and Karan Bhasin, an independent economist, said.

The real challenge will be governance. Sitharaman has said the DFI will be professionally run and has promised its executives competitive market-linked remunerative packages.

In some ways, the announcement of the new DFI is a step back to the future. India had started its development journey with many DFIs to fund its infrastructure requirements, especially in the first four decades after Independence.

Institutions such as IDBI, ICICI, IRCI, IDFC, etc., played a big role in the early years of industrialisation. But following the liberalisation process, many of them converted into full fledged commercial banks to access public deposits and their development finance expertise withered away

Now, realising the importance of having such as institution, and with an eye of taking the Indian economy towards its goal of achieving a GDP of $5 trillion, the Modi government has set up NaBFID.

It must be kept in mind that the DFI cannot be the magic bullet for dealing with India’s infrastructure deficit.

The real challenge will be to build the right governance structure. Finance Minister Nirmala Sitharaman has said the new DFI will be professionally run and has promised to ensure that its executives are given competitive market-linked remunerative packages.

This may be difficult in a government-owned DFI, where pay packages and other incentives would have to be in accordance with official paygrades.

At present, the salary structure of top management at leading private sector financial services companies can be as much as 50x to 100x that of senior government officials. Given this disparity, few private professionals would be willing to take up roles in the new DFI – unless the government can come up with an innovative structure that enables it to circumvent government pay scales.

Then, the government must also put in place institutional mechanisms to ensure that there is no political interference in the running of the DFI and also that errors in judgment do not lead to harassment of professional managers.

In this context, the Finance Minister’s utterances are reassuring. More on this once the fine print is out.